When you pick up a prescription for a generic drug, you might assume it’s just a cheaper version of the brand-name medicine. But behind that simple switch is a complex, highly structured decision made by your insurance company - one that affects what you pay, what you get, and sometimes even how well your treatment works.

Why Generics Are the Default

Insurance companies don’t randomly pick which generics to cover. They follow a system designed to save money without sacrificing care. The reason? Generics cost 80 to 85% less than brand-name drugs. In 2019 alone, Medicare Part D plans saved $141 billion by using generics instead of brand-name versions. That’s not just a small discount - it’s a massive financial shift across the entire healthcare system. The Food and Drug Administration (FDA) requires generics to have the same active ingredient, strength, dosage form, and route of administration as the brand-name drug. They must also meet the same strict manufacturing standards. That’s why insurers trust them. But that doesn’t mean every generic gets covered. The real decision happens behind closed doors, inside Pharmacy & Therapeutics (P&T) committees.How P&T Committees Make the Call

Every major insurer - whether it’s Medicare Part D, UnitedHealthcare, Cigna, or a regional Blue Cross plan - has a Pharmacy & Therapeutics committee. These are groups of doctors, pharmacists, and health economists who review drugs before they’re added to the formulary. Their job isn’t to pick the cheapest option blindly. It’s to pick the safest, most effective, and most cost-efficient one. They look at three things:- Clinical effectiveness: Does the drug actually work? Is there solid evidence from real-world studies, not just clinical trials?

- Safety: What’s the track record for side effects? Are there known risks for older adults, pregnant people, or those with other conditions?

- Cost-effectiveness: If two generics do the same job, but one costs $5 and the other costs $15, the cheaper one wins - unless there’s a clear clinical reason not to.

Tiered Formularies: The Hidden Pricing System

Your insurance plan likely uses a tiered formulary - a list that sorts drugs into levels based on cost. Generics almost always land in Tier 1, the lowest-cost tier. Here’s how it typically breaks down:| Tier | Drug Type | Average Copay (30-day supply) |

|---|---|---|

| Tier 1 | Preferred generics | $0-$15 |

| Tier 2 | Non-preferred generics | $15-$35 |

| Tier 3 | Brand-name drugs | $40-$100+ |

| Tier 4 | Specialty drugs | $100-$500+ |

What Happens When Your Generic Isn’t Covered?

Sometimes, even if a generic is FDA-approved, your plan won’t cover it. Maybe it’s a newer version that hasn’t been reviewed yet. Or maybe your insurer only covers one brand of generic for a particular drug - and they picked a different one. That’s when you need an exception request. You or your doctor can ask your insurer to cover the drug anyway. You’ll need to show that:- The covered generic caused side effects you didn’t have before

- You tried it and it didn’t work

- You need a higher dose than your plan allows

Therapeutic Substitution: When the Pharmacist Switches Your Drug

Here’s something many people don’t realize: even if your doctor prescribes a brand-name drug, your pharmacist can legally switch it to a generic - unless your doctor writes "Do Not Substitute" on the prescription. In 78% of commercial insurance plans, pharmacists are required to substitute generics at the counter. That’s meant to save money - but it’s not always smooth. A 2023 Drug Topics survey found that 31% of patients reported side effects or reduced effectiveness after being switched to a different generic version. That’s not because generics are unsafe. It’s because different manufacturers use different inactive ingredients - fillers, dyes, coatings - that can affect how the drug is absorbed, especially in people with sensitivities.What’s Changing in 2025 and Beyond

The landscape is shifting fast. The Inflation Reduction Act of 2022 capped Medicare Part D out-of-pocket costs at $2,000 per year starting in 2025. That means insurers can’t just shift costs to patients anymore - they have to manage drug spending more carefully. That’s pushing them to focus even more on high-volume generics. At the same time, the FDA is speeding up approvals. The Generic Drug User Fee Amendments (GDUFA III) aim to cut approval times from 42 months to 10 months. That means more generics will hit the market faster, giving insurers more options. But there’s a catch. As of October 2023, 78% of the 372 active drug shortages in the U.S. were for generic drugs. If a manufacturer can’t keep up, insurers are forced to scramble - sometimes switching to a less preferred generic, or even back to the brand-name drug.

Why Transparency Is Still a Problem

Despite all the rules and committees, one big issue remains: secrecy. Only 37% of insurers publicly share their full formulary decision criteria. You won’t find a detailed list of why one generic got in and another didn’t. That makes it hard for doctors to predict coverage, and for patients to understand why they’re being told they can’t get a certain drug. Some insurers, like UnitedHealthcare, score well on transparency - rated 4.2 out of 5 in a 2023 CAQH Index. Others, especially smaller regional plans, score below 2.5. That inconsistency creates confusion. A drug covered in New York might be denied in Wisconsin, even if it’s the same plan.What You Can Do

You don’t have to accept a denial without a fight. Here’s what works:- Ask your pharmacist: "Is there a generic covered by my plan?" They often know the formulary better than your doctor.

- Ask your doctor to write "Do Not Substitute" if you’ve had bad reactions to a specific generic before.

- If your drug is denied, request an exception. Provide documentation - even a note from your doctor saying it didn’t work or caused side effects.

- Check your plan’s formulary online. Most insurers list it under "Drug Coverage" or "Formulary Search."

- Consider switching to a plan with better generic coverage during open enrollment. Tier 1 copays vary widely.

The Bigger Picture

Generics aren’t just about saving money - they’re about making care affordable for millions. In the U.S., 87% of all prescriptions filled are for generic drugs. That’s because insurers made them the default. And for most people, it works: predictable costs, reliable results, and access to life-saving medications. But the system isn’t perfect. When cost-cutting overrides clinical nuance, patients pay the price - sometimes in side effects, sometimes in delays, sometimes in frustration. The goal should be balance: affordable drugs, yes - but not at the cost of safety or effectiveness. The next time you get a generic prescription, remember: someone on a committee decided this was the best option. You have the right to question that - and the power to push back if it doesn’t work for you.Why does my insurance only cover one generic for my medication?

Insurers often limit coverage to one or two generics per drug to negotiate the lowest possible price. They strike deals with manufacturers who offer the biggest discounts in exchange for being the only covered version. This doesn’t mean other generics are unsafe - just that they’re not part of the insurer’s negotiated contract. You can request an exception if the covered version doesn’t work for you.

Can I ask my doctor to prescribe a brand-name drug instead of a generic?

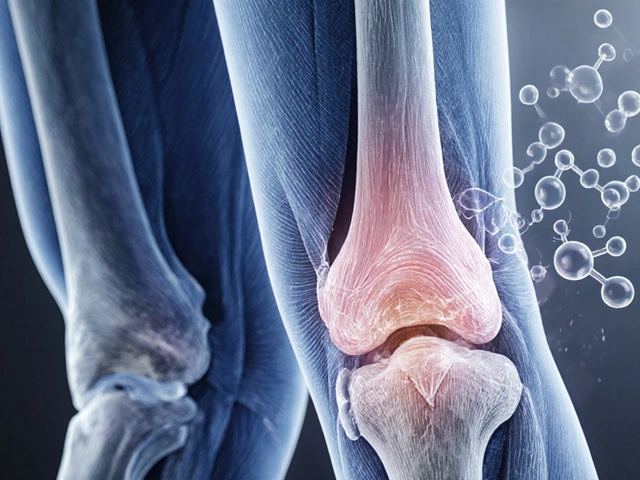

Yes, your doctor can prescribe a brand-name drug. But your insurer may require prior authorization or deny coverage unless you prove the generic doesn’t work for you. You’ll need documentation showing side effects, ineffectiveness, or a medical reason why the generic isn’t suitable. Some conditions, like epilepsy or thyroid disorders, often require brand-name drugs because small differences in absorption matter.

Are all generics exactly the same?

All generics must contain the same active ingredient and meet FDA standards for strength and purity. But they can differ in inactive ingredients - like fillers, dyes, or coatings. For most people, this doesn’t matter. But for some, especially those with allergies or absorption issues, switching between generics can cause side effects or reduce effectiveness. If you notice changes after a switch, tell your doctor and pharmacist.

Why do some generics cost more than others on my plan?

Even within generics, insurers create tiers. "Preferred" generics are the ones they’ve negotiated the lowest price for - usually $0-$15. "Non-preferred" generics are still generic but cost more because the insurer didn’t get a good deal on them. You might pay $20-$35 for these. Always ask your pharmacist which version is preferred on your plan.

How do I find out what generics my insurance covers?

Log into your insurer’s website and look for "Drug Formulary" or "Covered Medications." You can search by drug name and see which version is covered and at what tier. You can also call customer service and ask for your plan’s current formulary. If you’re switching plans during open enrollment, compare formularies - coverage varies widely between plans.

Written by Martha Elena

I'm a pharmaceutical research writer focused on drug safety and pharmacology. I support formulary and pharmacovigilance teams with literature reviews and real‑world evidence analyses. In my off-hours, I write evidence-based articles on medication use, disease management, and dietary supplements. My goal is to turn complex research into clear, practical insights for everyday readers.

All posts: Martha Elena